- Simple accounting for small business in excel pro#

- Simple accounting for small business in excel professional#

It is possible to add additional Workbooks at the bottom of the current spreadsheet.

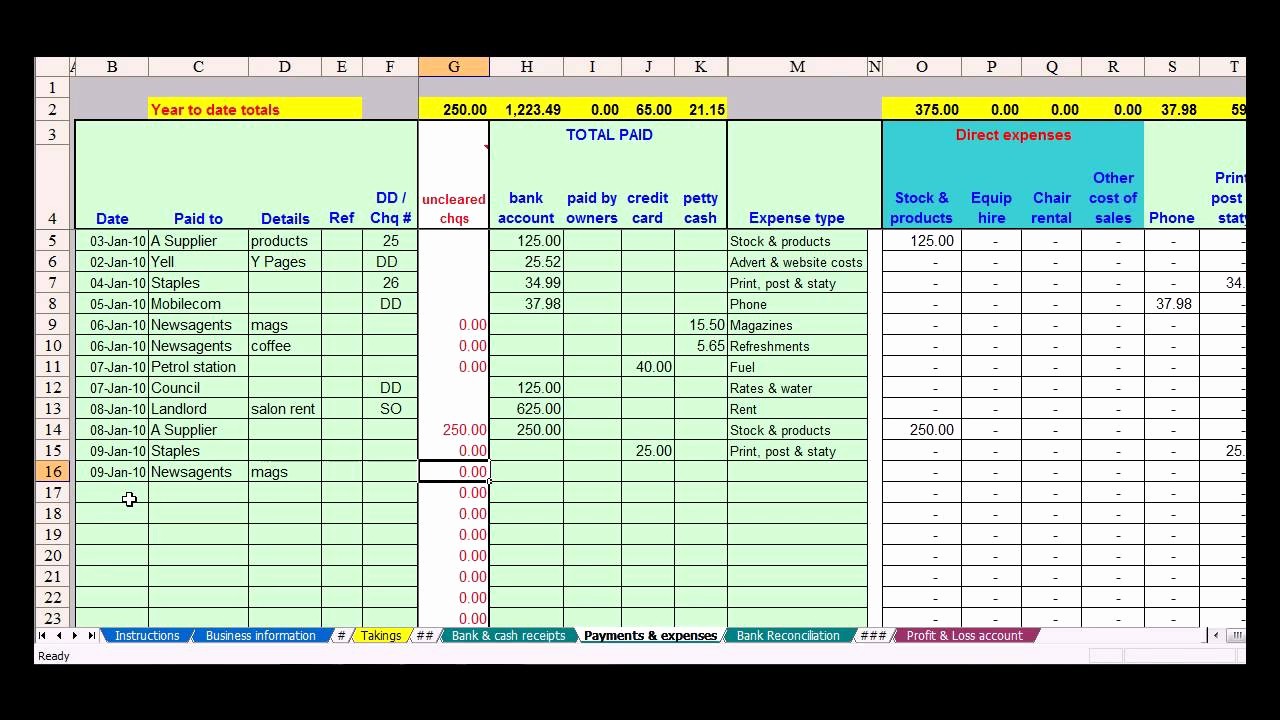

In Microsoft Excel, create a Blank Workbook. Step 2Īfter choosing which type of bookkeeping entry you’d like to create, the next step is to create a spreadsheet. This further allows business owners to see increases (debits) and decreases (credits) and their relationship with the five accounts. While single-entry bookkeeping comprises expenses and income, double-entry bookkeeping consists of expenses, income, and debits and credits. Double-entry bookkeeping differs from single-entry bookkeeping in that double-entry spreadsheets track both equity and liabilities. This option is suitable for larger businesses that perform more frequent and intensive transactions. This form of bookkeeping is also unique because only expenses (negative) and income (positive) transactions are recorded.ĭouble-entry bookkeeping is also possible in Microsoft Excel. Single-entry bookkeeping is suitable for smaller businesses that experience fewer business transactions. Business owners using Microsoft Excel can choose from two kinds of bookkeeping entries: single-entry and double-entry. Select the spreadsheet that is best for your bookkeeping needs. If you choose a DIY process, it is possible to create a simple bookkeeping spreadsheet in Microsoft Excel. There are dozens of templates available for users to select. The process for DIY bookkeeping spreadsheets continues below. Errors can occur if a category, description, or transaction amount is incorrect.Īn advantage is that you can complete the same bookkeeping spreadsheet in far less time, especially if multiple spreadsheets or workbooks are involved.

Simple accounting for small business in excel pro#

Simple accounting for small business in excel professional#

Whether you choose a DIY process or an accounting professional to create your bookkeeping spreadsheet, it is essential to know what to track. There are a few things to consider, especially if you want to make the bookkeeping spreadsheets yourself. The use of a spreadsheet allows you to see all of your transactions in one place. Every transaction that occurs will affect how your business allocates its finances. Bookkeeping is a practical way to make sure that your business can track its budget.

0 kommentar(er)

0 kommentar(er)